TACH can make you up to $40k more, per unit each year

Quickpay just helps today. TACH protects tomorrow.

TACH transforms unpredictable cash flow into predictable uptime — turning surprise breakdowns into solved problems.

Stop bleeding money.

Start running efficiently.

Business banking for independent carriers.

TACH replaces your traditional business banking setup

TACH replaces your traditional business banking with an intelligent trucking-specific account that automates budgeting, stabilizes cash flow, improves uptime, and unlocks large fleet benefits - even if you run just one truck.

What do you get with TACH?

How TACH reduces downtime & increases revenue

Step 1

Open your TACH account - built for efficiency

Create a TACH business account2 with a commercial card1 (TACH Trucker Funding Program Visa® Prepaid card1) for each truck.

Route all deposits to TACH for automatic tracking of every mile, load, and expense.

You instantly gain the visibility and stability most small fleets never have.

More insight = better decisions = higher efficiency.

Step 2

TACH automatically manages your money & maintenance

Every factoring or broker payment flows directly into TACH. Our Smart Budgeting Engine automatically allocates funds for:

Once essential expenses are funded, TACH transfers your net profit to your existing personal account. You always know what's covered, what's available, and what's truly profit — improving stability and eliminating costly surprises.

Predictable maintenance = fewer breakdowns = less downtime.

Step 3

Your increased stability unlocks large fleet benefits

When your trucks run efficiently and your finances stay steady, you qualify for benefits usually reserved for fleets with thousands of units — helping you stay on the road, finish more loads on time, and increase revenue per mile.

Reliability becomes

your competitive advantage.

Exclusive benefits for

TACH carriers

(All designed to reduce downtime, increase reliability, and boost revenue.)

24/7 TACH roadside assistance

Nationwide coverage through FleetNet, billed through TACH, and settled later.

Discounted premium Bridgestone tires

Save up to $100 per tire at 3,500+ locations nationwide.

Truck rentals with Penske & Ryder

When a truck goes down, get a rental fast — with discounted rates and up to $10,000 off deposits.

Cash advances for unexpected repairs

Same-day access to repair capital at up to 10% lower APR than traditional credit cards

Higher-Paying freight opportunities

TACH Certified Carriers earn 5-10% more per mile and receive priority access to premium freight.

Improve your on-time delivery rate

This boosts your carrier score, increases broker trust, and leads to even more dedicated lanes.

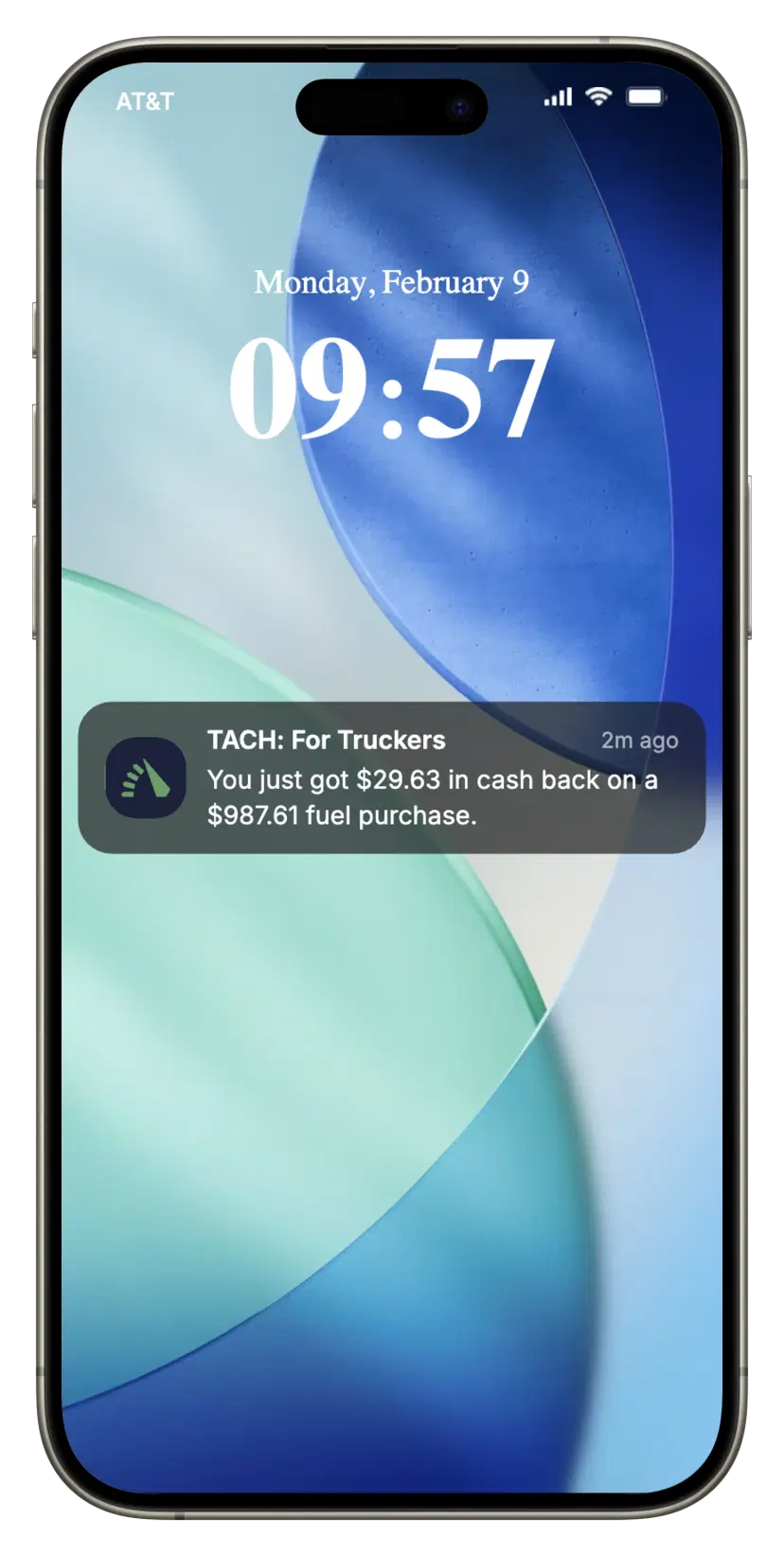

Get 3% cash back on fuel and 2% cash back on everything else.

Every swipe earns you money back - fuel, maintenance, parts, and more. Pro members maximize savings on every dollar spent.

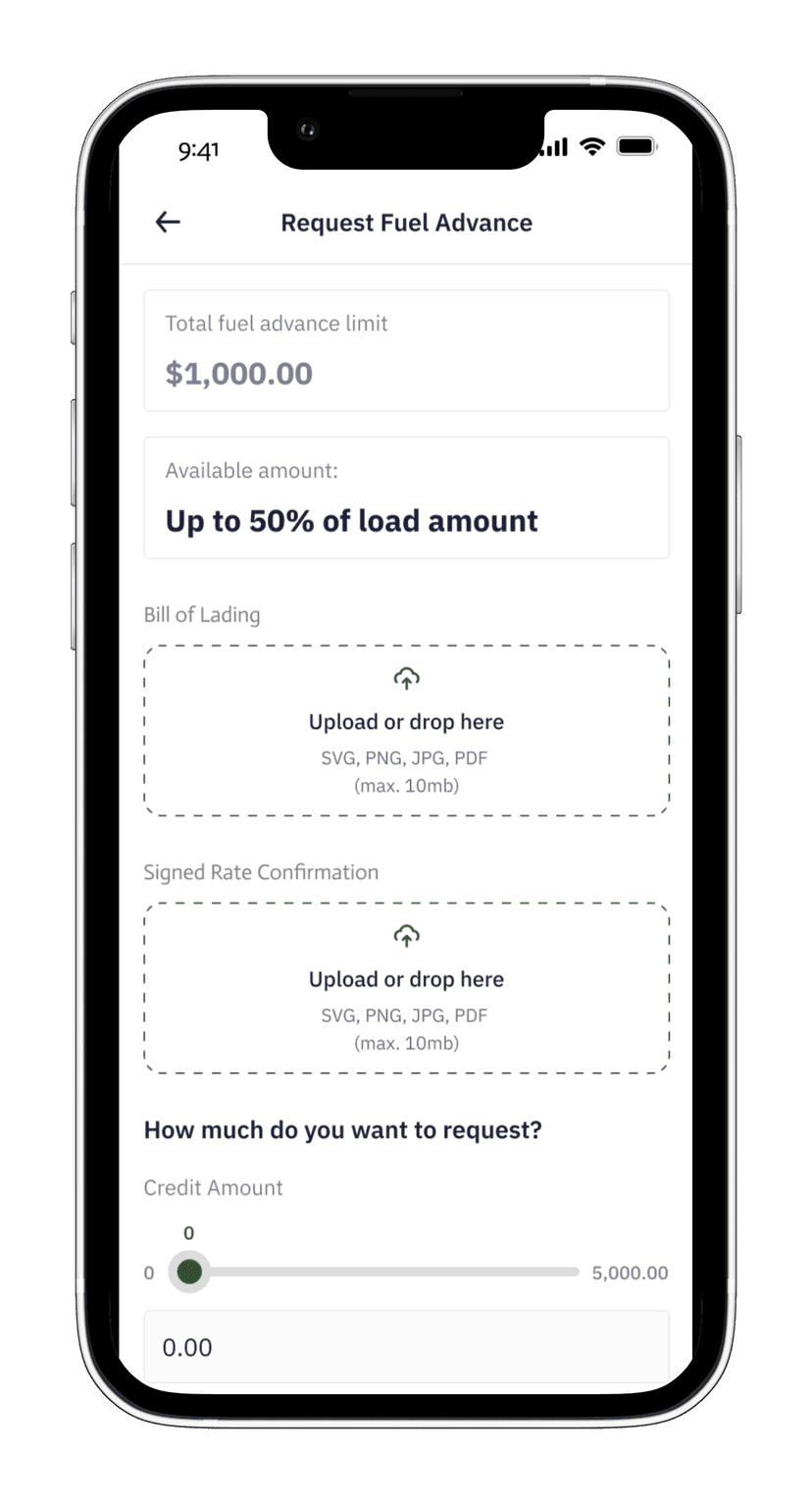

Up to $1,000 in fuel advances - delivered in as fast as 1 hour.

Get up to 50% of your load amount advanced same-day so you can fuel up and keep rolling. No waiting on brokers, no cash flow gaps - just the capital you need, when you need it.

Most fleets lose almost 30 days from unexpected downtime per truck, every year — and with it, nearly $25,000 or more in lost revenue. Breakdowns take trucks off the road, delay deliveries, and crush cash flow

TACH eliminates

that inefficiency.

By keeping your fleet financially stable, well-maintained, and operationally predictable, TACH helps you turn days of downtime into hours, recover lost revenue, and earn more per mile from brokers who trust your reliability.

No contracts. No minimums.

No hidden fees.

Starter

$99 one-time app fee

For new carriers getting started with TACH

Core

per truck / month

For established carriers who want cashback rewards

Pro

of revenue deposits

For high-volume fleets seeking maximum value

We're not factoring.

Instead, TACH powers your business with...

Calculate your increased revenue with TACH

See how much additional revenue your fleet could generate with TACH’s premium rates and reduced downtime. Our broker partners typically offer approx. 5% higher rates. TACH carriers can save an estimated 25-30 days of unexpected downtime annually.

Your fleet size

Avg. 100,000 miles

Based on approx. 5% higher rates, 30 days of recovered downtime, after TACH Pro fee.

Disclaimer: These calculations are estimates based on industry averages and TACH partner data. Actual results may vary based on routes, cargo types, market conditions, and operational efficiency. The approx. 5% premium rate is based on average TACH partner broker rates compared to non-TACH carriers. This calculation assumes an average of 286 driving days per year. A 1.25% TACH Pro fee is deducted from gross revenue. The 25-30 days of maintenance downtime reduction is based on industry data and TACH's truck rental & 24/7 emergency roadside assistance programs. Multiple industry reports/surveys show small carriers are down on average of 25 - 30 days per year, due to unexpected breakdowns, repairs, and financial reasons.

TACH proudly sponsors industry leaders

At TACH, we believe in giving back to the trucking community that drives America forward. We're proud to sponsor these organizations that advocate for and support truckers every day.

Supporting those who move America forward

These sponsorships reflect our deep commitment to the trucking industry. By supporting organizations that advocate for truckers' rights, provide essential resources, and strengthen the industry, we're investing in the people who keep America moving - our customers.